Manage Invoices, Aged Receivables &

Collect Business Debt at hyper-speed

Smarter cash flow.

Less stress.

More control.

6EL∆ is the intelligent, human-centred fintech platform that helps businesses of every size take control of credit management and invoicing headaches.

Built to simplify debt recovery and automate time-consuming credit control, 6EL∆ makes getting paid faster easier and far less stressful.

Unlock your potential with 6EL∆

Sign up for our initial market beta release on November 3, 2025 and enjoy a 30% discount for the first year.

To make business debt recovery stress-free, accessible, and fair by empowering every business owner with a guided, no-risk path to reclaiming what they’re owed.

Why We're Called 6EL∆

The name 6EL∆ (pronounced Six-Ella) represents guidance, clarity, and partnership, the core values behind the system. It originated from the idea of reversal: taking something complex, stressful, or overwhelming and turning it into something simple, structured, and under control. That philosophy is embedded in how 6EL∆ helps businesses transform unpaid invoices into recovered cash flow.

The “6” symbolises balance and continuity, the constant cycle of business operations and cash flow. The “∆” (Delta) symbol represents change and progress, reminding us that financial health isn’t static; it evolves through insight, action, and support.

Together, 6EL∆ stands for more than just technology - it’s your Business Debt Co-Pilot: a trusted ally helping companies and professionals navigate financial challenges, recover value, and move forward with confidence.

Smarter cash flow. less stree. more control

Take control of your cashflow

Poorly managed or unpaid invoices can quietly destroy even the most successful companies.

6EL∆ gives you the tools, data, and automation you need to protect your business from late payments and recover outstanding debt before it damages your cash flow.

Simple. Affordable. Effective.

For just £39.99/month, you get up to 5 user licences, ideal for small teams, growing businesses, and finance departments that want to get ahead of their collections.

Connect your invoicing system

Sign up in minutes, Sync directly with Xero and QuickBooks in minutes. 6EL∆’s secure integration automatically imports your invoices and customer details - ready for intelligent monitoring and action.

Let 6EL∆ handle the chasing

Once connected, 6EL∆’s AI automatically manages your invoice reminders and overdue communications.

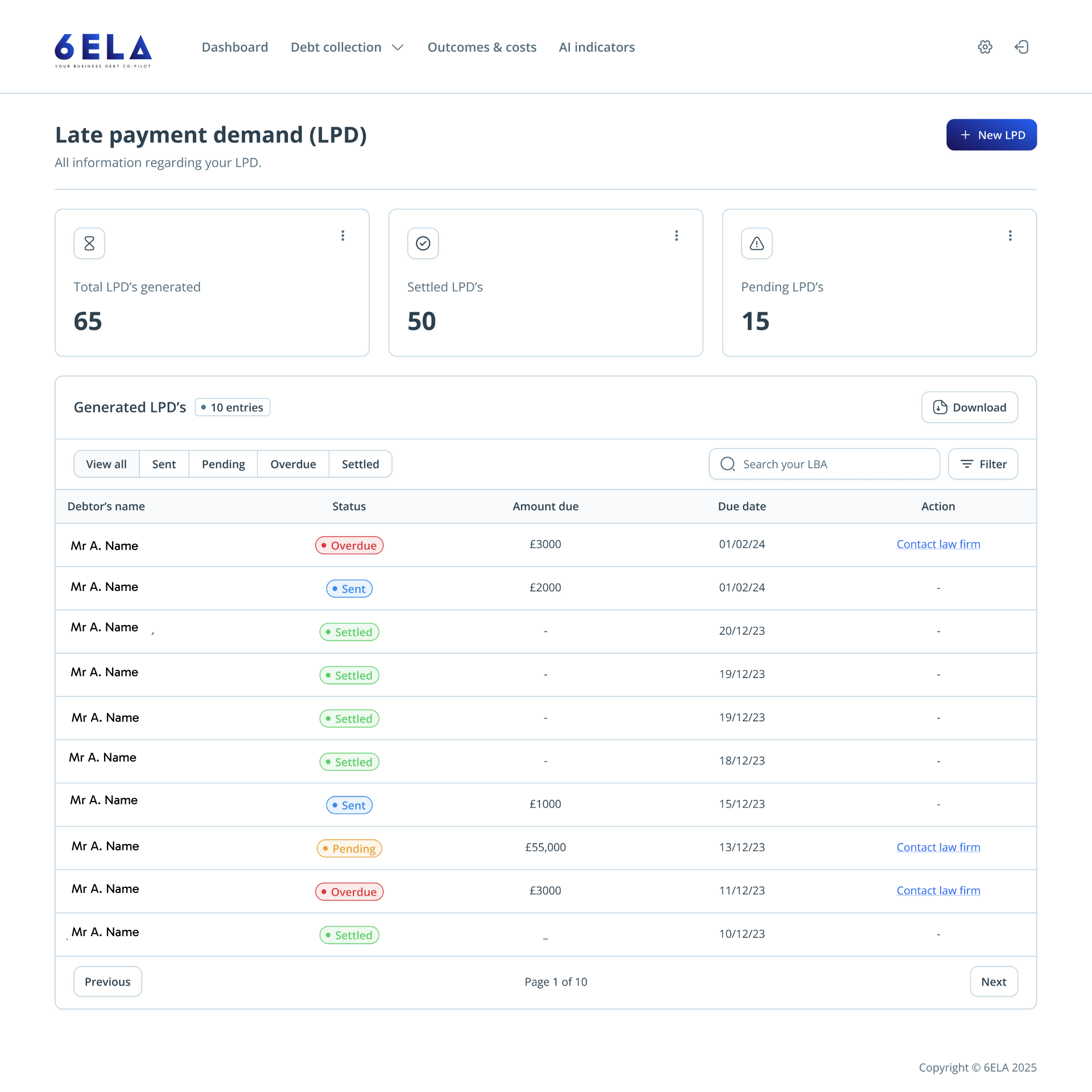

If invoices become aged, 6EL∆ steps in with its Pre-Letter Before Action (Pre-LBA) process - sending professional, compliant notifications to customers before legal escalation is needed..

Get paid - instantly and transparently

When your customers pay through the 6EL∆ system, funds are automatically transferred to your business account. A simple 5% success fee is deducted for collection - no hidden charges, no paperwork.

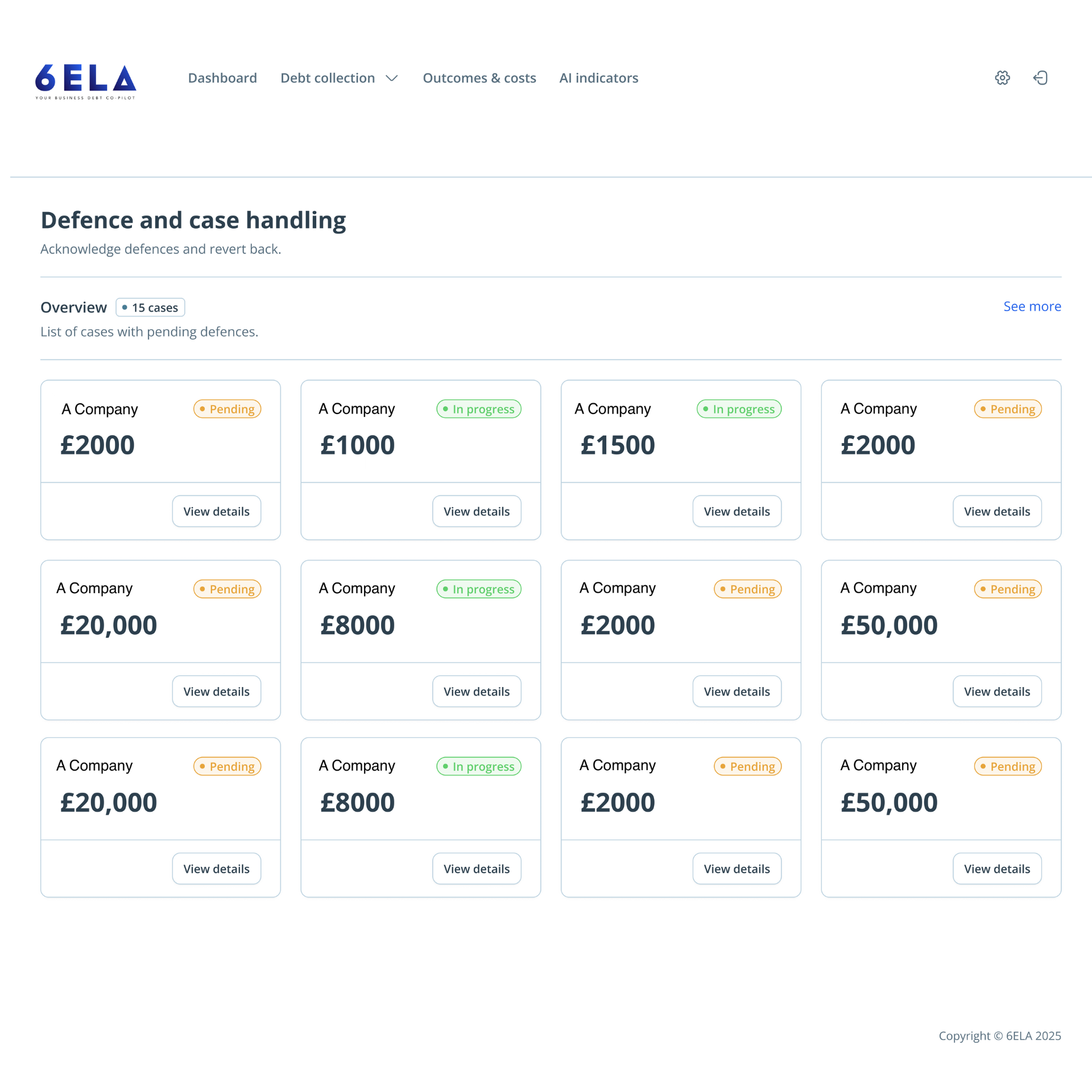

Escalate seamlessly when needed

If payment still doesn’t arrive, 6EL∆ connects you with specialist local law firms who can take over the legal process directly through the 6EL∆ platform.

Communication and updates happen within your 6EL∆ dashboard, ensuring transparency and speed.

6EL∆ streamlines the collection of overdue debt for businesses

Enhanced Features to Optimise Debt Collection.

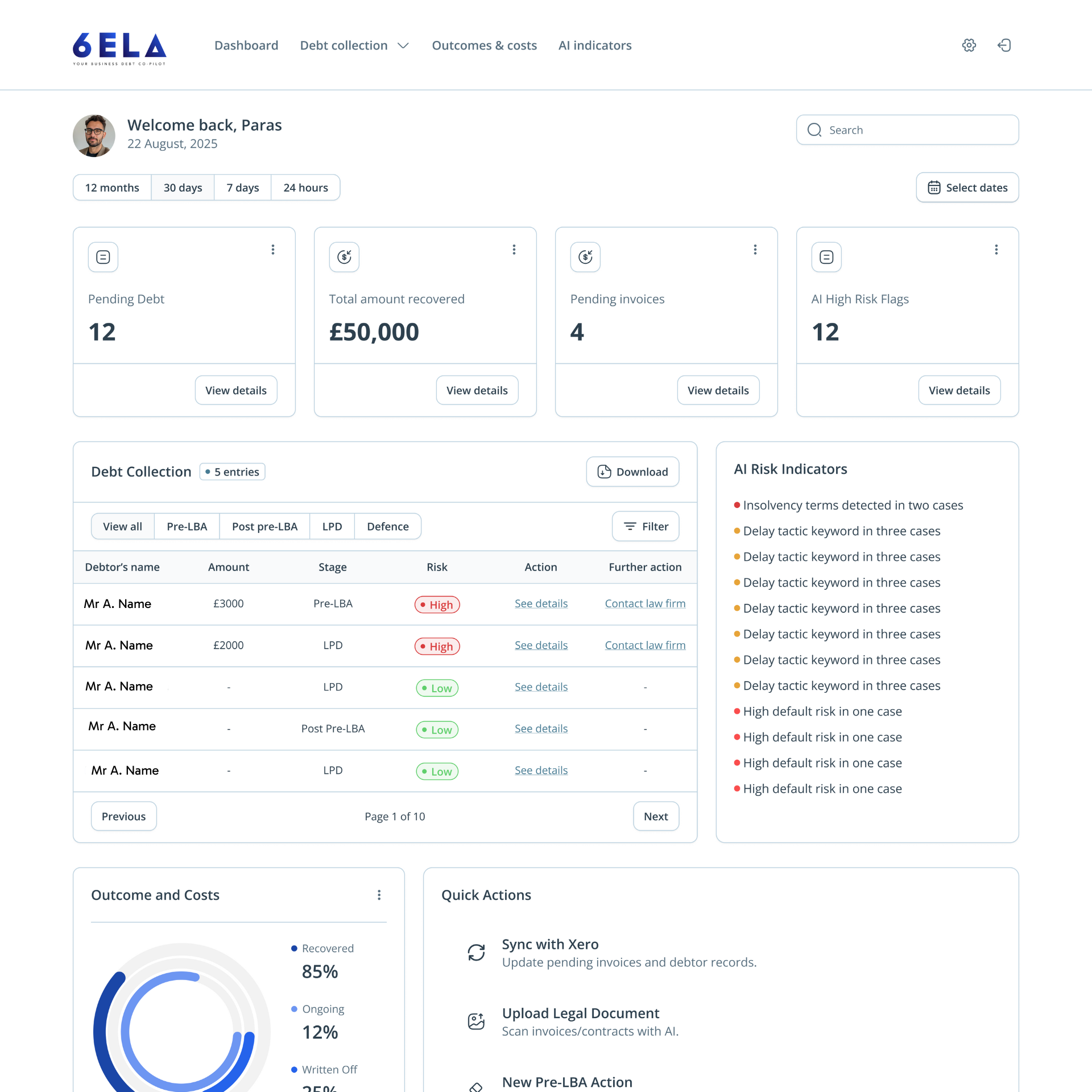

Track Debts Easily

6EL∆ keeps tabs on outstanding amounts, due dates, and payment statuses in one centralised dashboard.

Effortless Communication

6EL∆ communicates with debtors directly through the platform, streamlining the collection process.

Automated Generation

Using AI-driven automation, 6EL∆ generates standard legal documents like demand letters and court filings, resolving up to 82% of debt successfully.

Conflict of Interest Checks

Utilise 6EL∆ to conduct automated scans to identify potential conflicts of interest across clients and cases.

Customisable Billing

Flexible billing options to suit your needs, whether you're a company managing debts, a lawyer providing debt collection, or an accountant supporting clients.

AI Insights

Utilise 6EL∆ AI to analyse communication patterns, predict recovery rates, and identify potential legal challenges.

Unlock your potential with 6EL∆

Sign up for our initial market beta release on November 3, 2025 and enjoy a 30% discount for the first year.

Smarter insights. Better decisions.

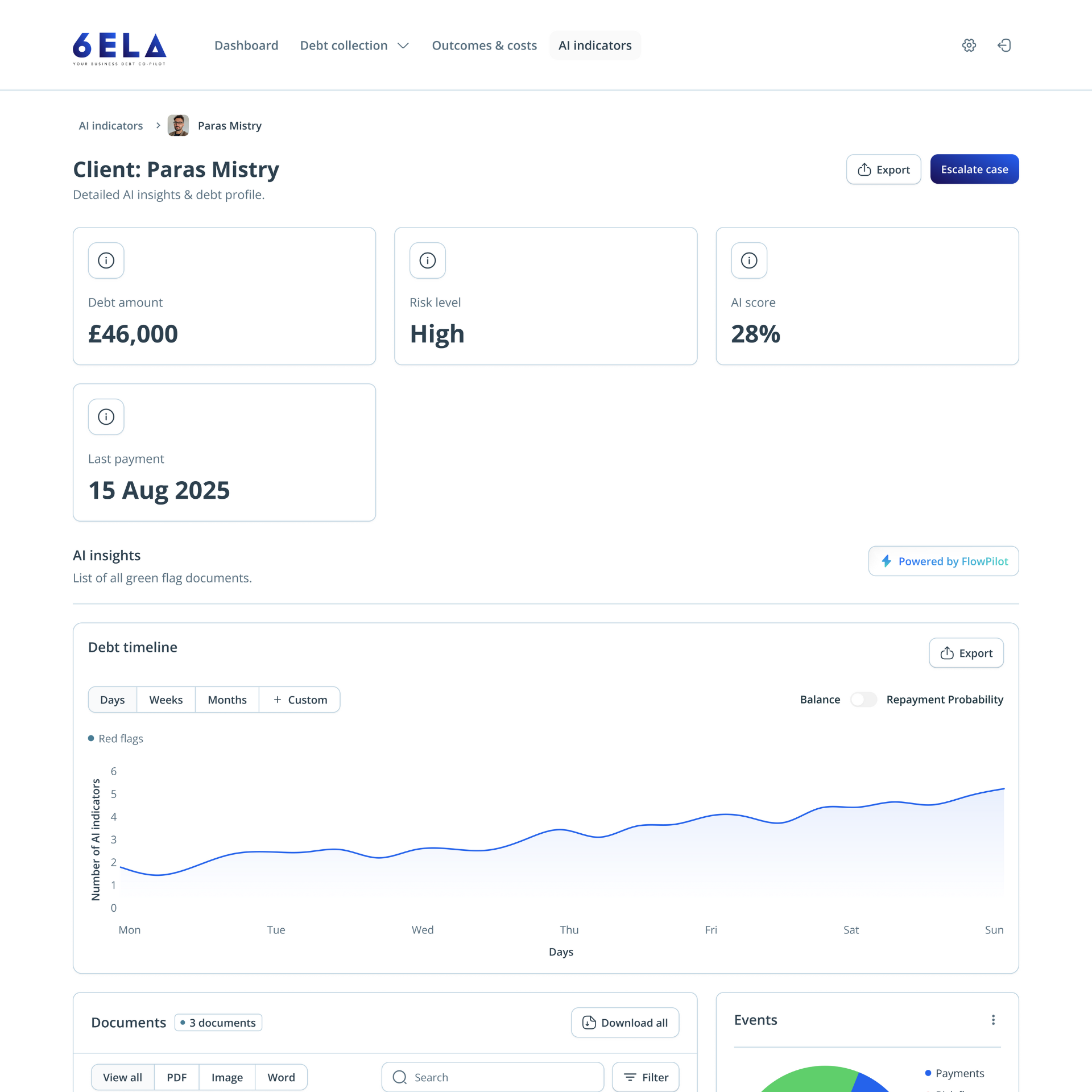

REAL-TIME VISIBILITY

6EL∆'s AI-driven dashboards give you real-time insights of:

- Whats owed and whats overdue

- Customer payment behaviour trends

- Invoices approaching risk thresholds

- Recovery progress and success rates

- Escalations to legal partners

You’ll instantly see which clients are improving, who’s slipping, and where your cash flow risks lie — all categorised by Low, Medium, or High priority to guide fast, confident decisions.

Why businesses choose 6EL∆

Smarter cash flow. Less stress. More control

Debt Chasing

Automated invoice chasing powered by AI

Legal Network

Integrated legal network for seamless escalation

Real

Time

Real-time cash flow insights

High Recovery

Up to 82% recovery rates during pre-LBA phase

Great

Pricing

Affordable pricing with transparent success fees

Pricing That Puts You in Control

No upfront fees. No subscriptions. No risk.

Whats included within my 6EL∆ subscription of £39.99/month

6EL∆ is risk free and can be cancelled at anytime, there are no lengthy contracts.

5 user account access account access. £3 per additional users past allowance of 5.

Sync & manage as many debts as you require.

Real-time cash flow insights and instant insights into your aged debt.

Manage invoice chase process with a three-step automated approach before pre-LBA.

AI generated letters & automated nudges.

Full support & step-by-step guidance.

Direct access to integrated legal network for seamless escalation.

Legal-ready escalation tools.

Frequently Asked Questions

Everything you need to know about the product and billing.

What is 6EL∆ ?

6EL∆ is a smart fintech platform that helps businesses manage credit control, automate invoice chasing, and recover overdue payments.

Acting as your Business Debt Co-Pilot, it combines automation, data insights, and access to legal partners to make debt management simple, affordable, and stress-free.

Who can use 6EL∆ ?

6EL∆ is built for businesses of any size that issue invoices - from small startups to established enterprises.

It’s also designed for professional service providers such as accountants, bookkeepers, and solicitors who manage or advise clients on financial matters.

How does 6EL∆ integrate with my existing systems?

You can securely connect 6EL∆ to your Xero or QuickBooks account in just a few clicks.

Once synced, your invoices and customer data are automatically imported so 6EL∆ ’s AI can track payment progress, chase overdue invoices, and provide real-time insights.

What happens when an invoice becomes overdue?

When an invoice ages beyond its payment terms, 6EL∆ automatically begins its Pre-Letter Before Action (Pre-LBA) process.

This sends a professional, legally compliant reminder to the customer, giving them a fixed period to pay before legal steps begin. Most debts are resolved at this stage.

What if my customer still doesn’t pay after reminders?

If payment isn’t made after the Pre-LBA stage, 6EL∆ connects you with a local specialist law firm from its partner network.

The firm takes over the case directly through the 6EL∆ system, ensuring all communication and documentation remain in one secure place.

How much does 6EL∆ cost?

6EL∆ costs £39.99 per month for up to five user licences - perfect for small teams or credit control departments.

A 5% collection fee applies only when debt is successfully recovered through the 6EL∆ platform. There are no hidden fees or long-term contracts.

What recovery rate can I expect?

During initial testing, businesses using 6EL∆ ’s automated Pre-LBA process achieved an 82% recovery rate without needing to involve external solicitors.

This success comes from timely reminders, structured communication, and intelligent escalation when needed.

How does 6EL∆ handle payments once a debt is collected?

When a debtor pays through the 6EL∆ system, the payment is processed securely.

6EL∆ deducts a 5% collection fee and transfers the remaining funds directly to your business bank account - fast, simple, and transparent.

How secure is my data?

Security is central to 6EL∆ . All integrations use bank-grade encryption, and your data is stored within UK-compliant, GDPR-approved servers.

Only authorised users and approved legal or accounting partners can access case information.

What insights does 6EL∆ provide?

The 6EL∆ dashboard gives you a live overview of your credit control health — showing:

- Total invoiced, collected, and outstanding amounts

- Debts in pre-LBA and LBA stages

- Customer payment behaviour trends

- Risk indicators (low, medium, high)

These insights help you make smarter credit decisions and predict cash flow challenges before they occur.

- Total invoiced, collected, and outstanding amounts

What is 6EL∆ for Professional Services?

Accountants, bookkeepers, and solicitors can join 6EL∆ Professional Services to manage their clients’ debt processes directly within the platform.

They can track payments, prepare for legal escalation, and receive referral income when clients sign up.

How does the referral and lead system work for professionals?

Professional members pay £249/month and receive a £25 lead fee for each client they refer.

They also gain access to client dashboards, communication logs, and secure documentation sharing, helping them support their clients efficiently and compliantly.

How do I get started with 6EL∆ ?

It’s simple - click Create Account, connect your accounting software, and 6EL∆ does the rest.

Within minutes, your invoices are synced, your dashboard is live, and your business has a powerful co-pilot ready to keep cash flow steady and stress-free.

6EL∆ For Professional Services

Accountants. Bookkeepers. Solicitors

6EL∆ serves not only business owners but also acts as a robust ally for professionals overseeing client finances, providing them with essential tools and resources that enhance their efficiency and effectiveness.

By offering tailored solutions, 6EL∆ empowers these professionals to better manage their clients' financial needs while ensuring that they can navigate complex monetary landscapes with confidence and expertise.

Join the 6EL∆ Professional Network to:

Add and manage your clients in one place

Receive referral revenue on every new sign-up

Access full debt-tracking and communication logs

Streamline escalation to legal partners or to manage escalations sent to your company

Ensure all documentation is court-ready if required

Professional plans start at £249/month + £25 per referred lead, and include full access to 6ELA’s client management dashboard.

Whats included within my 6EL∆ Professional Service subscription of £249.99/month

6EL∆ is risk free and can be cancelled with 30 days notice at anytime, there are no lengthy contracts.

5 user account access account access. £3 per additional users past allowance of 5.

Sync & manage as many client debts as you require.

Real-time client cash flow insights and instant insights into your aged debt.

Manage client invoices and launch chase processes with a three-step automated approach before pre-LBA.

AI generated letters & automated nudges.

Full support & step-by-step guidance.

Direct access to integrated professional network for seamless escalations and referrals.

Legal-ready escalation tools.

Contact the 6EL∆ Team

We are currently accepting early access to the both the company and professional services offering.

Contact us if you would like early access.

Contact Us

Thank you for submitting your early access request. A member of the Debt Co-Pilot team will get back to you as soon as possible.

Please try again later.

We are now offering early access to 6EL∆. If you wish to gain entry to the system, please fill out the form, and a team member will reach out to you shortly.

6EL∆ BETA launches in...

6EL∆ is now live

Unlock your potential with 6EL∆

Sign up for our initial market beta release on November 3, 2025 and enjoy a 30% discount for the first year.